August 9, 2024

Last Will Certainly And Testament What It Is, When You Need It, Just How To Create It

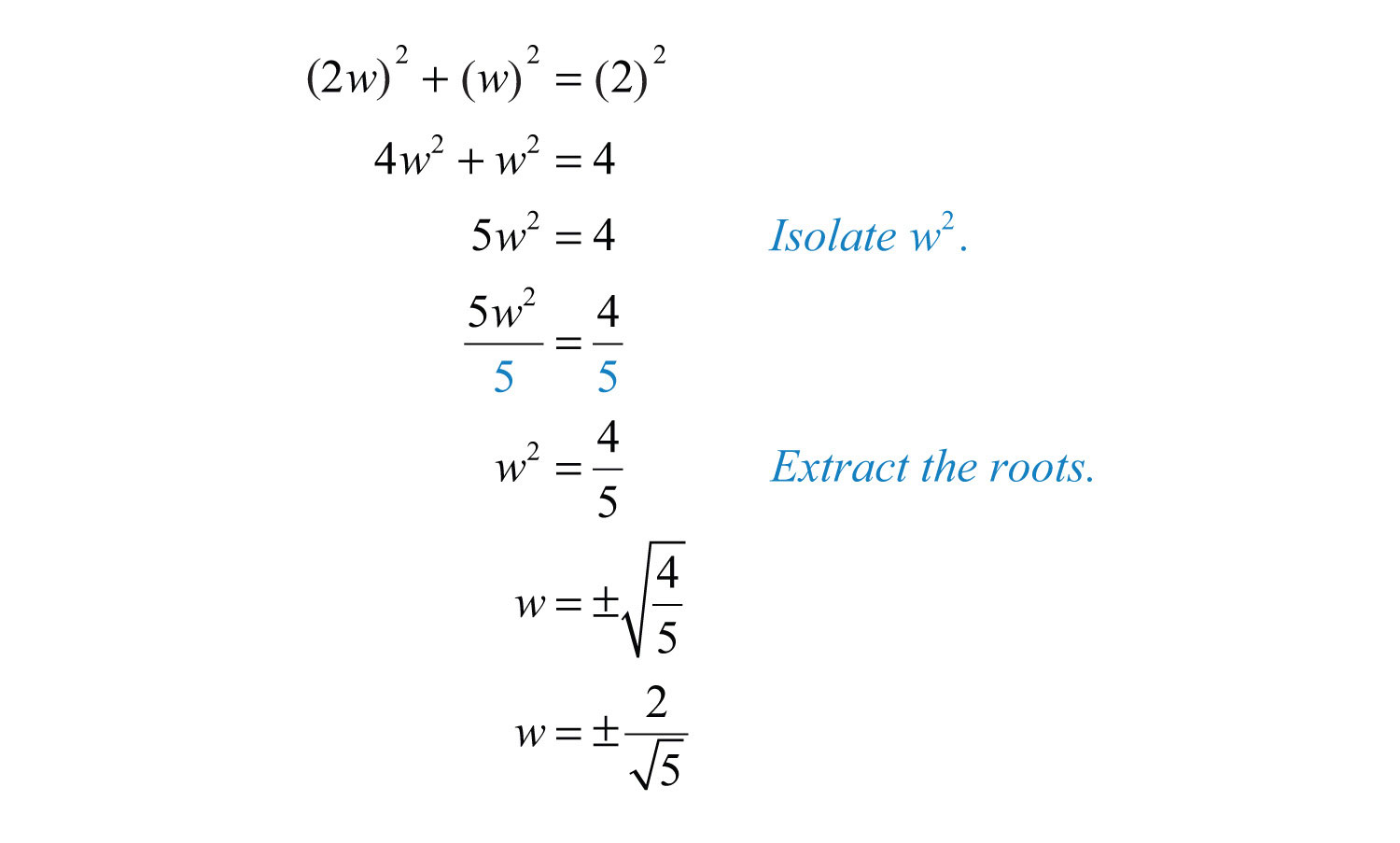

For How Long After Fatality Is A Will Check Out? Obtaining The Inheritance! Absolutely, if you are not sure about the lawful implications of your distribution plan. Then you would benefit from an assessment with an estate preparation attorney. However as you grow older and obtain more building, you might wish to take part in a lot more sophisticated planning. Because they're written in high-stress scenarios, they can negate various other papers or have errors. In other instances, a deathbed will certainly might unintentionally omit essential information.What Takes Place If I Die Without A Will?

You can likewise call a recipient in a "residuary" provision in your will. He or she will acquire anything left over after your estate circulation. These taxes do not relate to making it through partners or to payments from life insurance policy policies. Rather, inheritance taxes usually just put on more distant loved ones and beneficiaries. It's unlikely this tax affects you, however it's excellent to be aware of it if you reside in one of the six states that use it. While inheritance tax are owed to the federal government, estate tax are owed to the state government.Management Procedure

Final stage of preparations for Interim Union Budget 2024 commences with Halwa Ceremony - PIB

Final stage of preparations for Interim Union Budget 2024 commences with Halwa Ceremony.

Posted: Wed, 24 Jan 2024 08:00:00 GMT [source]

- This means that if among the partners passes away, the enduring companion can not customize the regards to the joint will certainly or establish that would acquire their property.

- This can preserve the testator's personal privacy far better than various other types of wills.

- Much of the estate can be lost to legal charges, as we have actually seen with star fatalities like Royal prince.

- Nevertheless, others only accept verbal wills from clients near death with no possibility of recovery.

Can a youngster be a recipient?

Social Links