Pour-over Will Certainly Wex Lii Lawful Details Institute

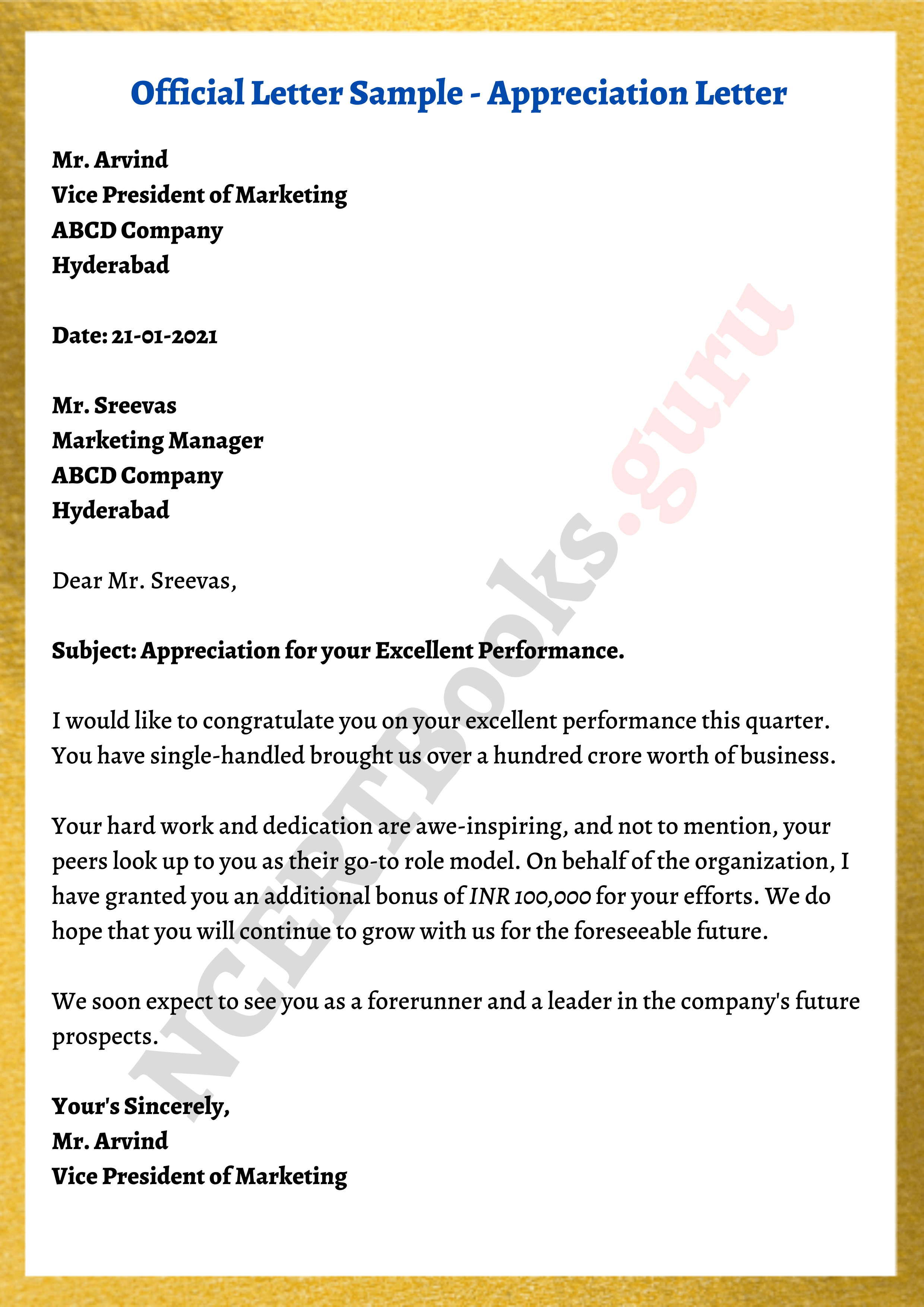

Living Count On And Pour-over Will: Operating In Tandem Understanding On Estate Preparation A living will is a legal document that details how you like to obtain clinical therapy when you can no more make decisions on your own. This overview highlights the advantages of a living will certainly and why you must urge liked ones to create one. Like pointed out above, the pour-over will certainly is a security gadget to ensure your possessions flow to your designated recipients. For instance, if you do not retitle your automobile into the trust, it could be viewed as component of your individual properties rather than a trust property.620 Colonial Road Sells for $4.1 Million: Guilford Property Transactions Jan. 10th-17th - Patch

620 Colonial Road Sells for $4.1 Million: Guilford Property Transactions Jan. 10th-17th.

Posted: Fri, 18 Jan 2013 08:00:00 GMT [source]

What Are The Benefits Of Earning A Living Count On With A Pour-over Tool?

In California, however, a trustee can be named, and a trust fund produced, after the decedent has currently passed away. By developing a trust within certain period explained by code, the decedent can still have a valid trust fund and pour-over will. The good news is, most of the times, not excessive property goes through a pour-over will. If you do good job of estate preparation, you'll transfer all of your valuable possessions to the depend on while you're alive. Only the leftovers-- points https://s3.us-east-1.amazonaws.com/family-will-services/will-writing-service/will-writing-experts/can-i-see-copies-of-earlier-wills-my-mommy.html of minor worth-- must pass under the regards to the will.Get Assist With California Estate Planning

Most smaller sized estates use revocable living depends on, which allow grantors to control the possessions in the trust until they die. Because the proprietor keeps such a degree of control over a revocable trust fund, the properties they put into it are not protected from creditors the means they are in an irrevocable trust. If they are sued, the trust fund possessions can be bought sold off to please any judgment presented. When the owner of a revocable count on passes away, the assets kept in depend on are likewise based on state and government estate taxes.- In these territories, if the depend on is revoked by the testator and the pour-over provision is neither amended neither erased, the pour-over gift lapses.

- The beneficiary receives any kind of accounts and residential or commercial property that you own in your name alone at the time of your death.

- The trustee then disperses the possessions to the beneficiaries under the trust's terms.

- Or, you might find possessions from deceased family members' estates that have yet to be distributed to you.

- The idea is to decrease the probate procedure and make certain that assets are distributed as the deceased dreams.

- Whatever you require to know to protect you and your household, all in one place.

What is the best kind of depend have?

You can likewise make just the right amount of coffee to ensure that it's as fresh as possible and you make less waste.'M irrors can conveniently make your area really feel bigger & #x 2013; however at the very same time & #x 2013; they have a tendency to show much energy throughout the room. This will influence and deplete [the space's] power,' claims specialist Nishtha Sadana from Decorated Life. This can' impact your health and wellness and health by interrupting your sleep and cultivating sleeplessness.'. However, grantors aren't always able to move every one of their assets into a trust in time. That's where pour-over wills can be found in. Consider a pour-over will as a failsafe. If any properties are unaccounted 'for, a pour-over will guarantees they're automatically put in a trust for a grantor's called recipients. The big difference is that a pour-over set consists of a carafe and a paper filter, not a mesh filter like a French press has. To make a mug of pour over, you just position the filter in the top of the carafe, pour in your ground and after that put warm water over this.