August 7, 2024

Estate Planning Statistics To Check Out Before Composing Your Will

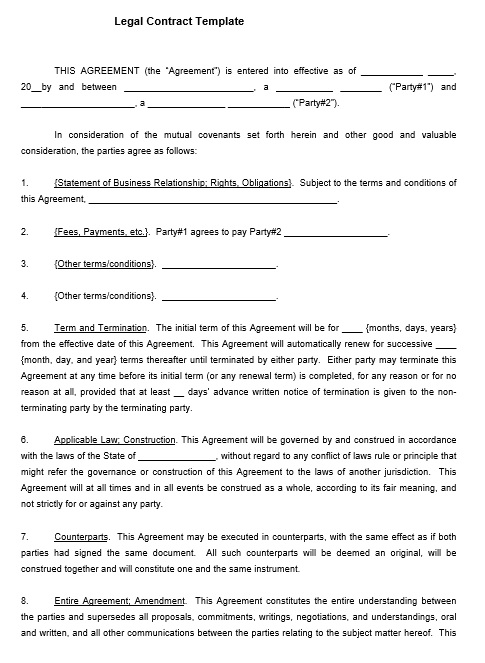

Why You Require A Will And The Consequences If You Pass Away Without It Similarly, if you have a savings account and you have what's called a "payable-on-death" or a "transfer-on-death" classification that you set up with the financial institution, that classification will certainly exceed whatever you state in your will. So, it is really important to comprehend what possessions you possess, how they're possessed, and which of those assets will pass under the will versus by legal rights of survivorship or a few other classification that you have made. Professionals in estate planning, ACTEC Fellows Elizabeth K. Arias and Jean G. Carter, response questions that households frequently have when preparing a will. It's where you can appoint an administrator, guardians for kids, and also describe funeral and funeral desires.Will Vs Count On: What's The Distinction?

Online will platforms, like Willful, make it simple to make a lawful will from the convenience Website link of your home. Not only do you obtain a legal document that is customized to your special life scenario, you can complete your will from the convenience of your home. You need a will if you desire to consist of a present or contribution to the charities you care about after you die (you additionally have the choice to leave a portion of your estate). Many organizations are supported by legacy giving and allow you to pay it ahead to help those that need it most. When you pass away without a will (called passing away "intestate") provincial regulation will dictate exactly how your estate is dispersed and might affect essential connections in your life that are not recognized by these laws. Common-law companions and other dependants you desire to attend to are vulnerable if you die without a will.Online will kits compared - CHOICE

Online will kits compared.

Posted: Fri, 24 Nov 2023 08:00:00 GMT [source]

Notable Wills

This post is for informative objectives just and is not meant as a deal or solicitation for the sale of any type of economic services or product. It is not created or meant to supply monetary, tax, lawful, financial investment, audit, or other professional suggestions since such advice constantly requires factor to consider of private circumstances. If specialist recommendations is required, the solutions of an expert advisor need to be looked for. This consists of how you wish to distribute your possessions, such as home or money, and also lays out guardians/custodians that you would certainly intend to take care of small youngsters and animals after you pass away. Your will certainly is also where you name that you want to resolve your affairs on your behalf-- referred to as an executor. It additionally suggests what resources will certainly be utilized to pay any type of estate taxes and financial debts that schedule, and it names an executor who will be responsible for the settlement of your estate. It ends with your trademark, the trademarks of needed number of witnesses, and normally a notary public's oath concerning the legitimacy of the various signatures. Congress is constantly examining facets of the estate and gift tax system. Your directions should be clear, utilizing the names of both your properties along with the specific names of the individual or people you wish to receive them. This makes it most likely that your dreams will be recognized as you mean. LegalZoom provides accessibility to independent attorneys and self-service tools. LegalZoom is not a law office and does not give legal advice, except where accredited via its subsidiary law practice LZ Legal Services, LLC. Do you want to make things less complicated for your liked ones when you pass away? If so, you will certainly need to have either a will or a living rely on area. This article will explain the significant differences between both alternatives and aid answer any inquiries you may have.- Even if you believe you have all your home held in nonprobate type (a living depend on), a will is still an excellent idea.

- You might wish to take into consideration a modest tradition to assist cover the additional costs involved in taking care of the pet and conference food and vets costs.

- In most states, the enduring partner or the closest living loved one will certainly inherit everything, but not always.

- The distinctions between a guardian of the home and counts on are incredible.

What are the benefits of free choice?

These researches have actually found that a stronger belief in free will is associated with much better work performance (Stillman et al., 2010), better academic accomplishment (Feldman et al., 2016), much less consistency (Alquist et al., 2013), and less dishonesty behavior (Vohs and Schooler, 2008).

Social Links