August 30, 2024

Estate Preparation Considerations For Local Business Owners

What Sorts Of Attorneys Do You Require For Your Service? Figure Out Right Here Blog For specialist services like plumbing or nursing, the state might call for certification with a third-party board to maintain your license. The dancing partner of resources need is the ideal monetary strategy and with it the right financing mix. A personal privacy plan is a declaration that informs your clients just how their data will be accumulated, utilized, kept, and secured. It needs to also information if there may be a requirement to share any type of individual info. Some offering approaches, such as on-line buying, require you to allow a 'cooling-off' period, throughout which time a customer can alter their mind about an acquisition and get a refund.Special Scenarios

One of the most usual is when they get filed a claim against by somebody or need to safeguard themselves versus lawsuits brought by others. An additional factor is when they intend to participate in contracts with companions or clients with legal implications. A service attorney can additionally provide useful advice on governing conformity, making sure that your firm complies with all pertinent legislations. and guidelines. The government life time gift and estate tax exception is $13.61 million per person and $27.22 million per married couple in 2024. For those that wish to transfer properties to kids, grandchildren, or various other member of the family and are concerned concerning present tax obligations or the problem of estate taxes your beneficiaries will certainly owe, an LLC can aid.- A will certainly and last testimony routes the personality of your properties, such as bank equilibriums, building, or prized properties.

- If you are mosting likely to be utilizing your vehicle for job, you will require to ensure you have guaranteed the vehicle for the proper class of usage.

- When the owner of an LLC dies, some states declare that the LLC has to dissolve unless a particular plan of sequence has been made.

- It is worth remembering that all business insurance policies are tax-deductible costs.

Top 7 Monetary Factors To Consider When Beginning A Small Company

This overall resets every year, and the provider pays the taxes instead of the receiver. This limitation uses per recipient, so providing $18,000 per kid and various grandchildren would certainly not incur present tax obligations. Unlike a firm, LLC members can manage the LLC nonetheless they like and undergo less state laws and formalities. As a collaboration, members of an LLC report the business's earnings and losses on their tax returns, as opposed Click here for more info to the LLC being strained as an organization entity. Binns claims selecting the right time to implement an estate freeze depends upon variables such as business owner's age, family members profile and finances.John And Kelly Learnt More About Laws And Laws Their Organization Needs To Comply With To Ensure It Runs Legitimately

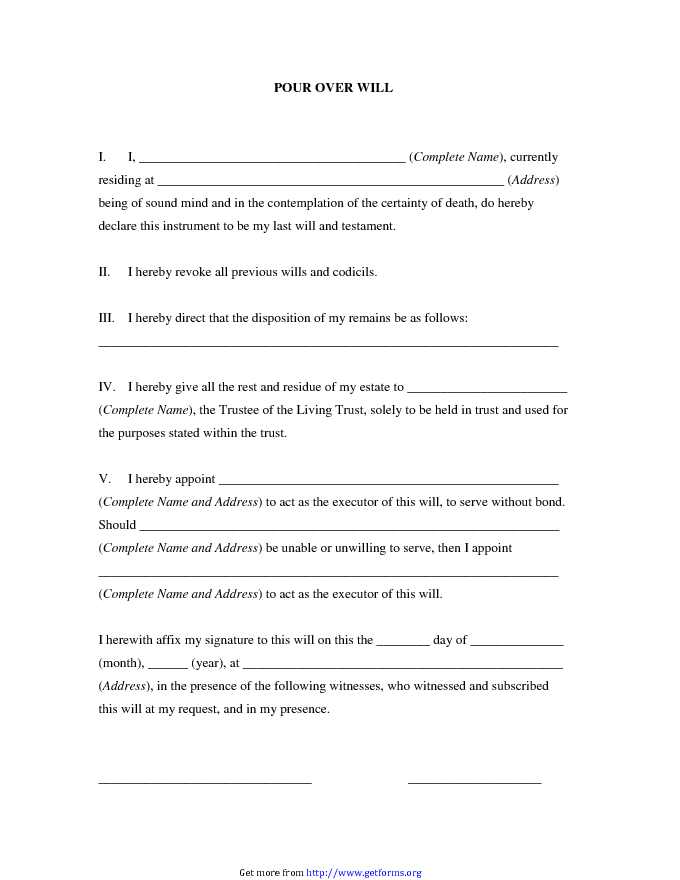

The 4 main kinds of wills are the simple will, the joint will, the testamentary trust will, and the living will. A will certainly ought to mark an administrator to carry out the will certainly's directions according to the desires of the deceased. A last will and testament can additionally deal with matters entailing dependents, the management of accounts, and economic rate of interests.Business Plan: What it Is, How to Write One - NerdWallet

Business Plan: What it Is, How to Write One.

Posted: Tue, 18 Jun 2024 07:00:00 GMT [source]

Social Links