August 27, 2024

Pour-over Wills Jacksonville Estate Preparation Attorneys Regulation Office Of David M Goldman

Pour-over Wills In California The Law Office Of Kavesh Small & Otis, Inc A trustee, unlike an administrator, doesn't require a court of probate's authorization to act. A pour-over will includes security and tranquility to a person's estate planning because any type of possessions that do deficient into the trust will pour into the trust fund at the testator's death. It is a protection meant to assure that any properties that were not included in the trust come to be possessions of the trust fund upon the party's death. This saves the testator the additional effort of having to frequently include or replace trust assets based upon home got or transferred throughout his lifetime. With a pour-over will, the testator requirement only consist of certain useful home in the depend on, and all various other residential or commercial property is covered by the will. The trust is the key mechanism for distribution, and the pour-over will certainly picks up any kind of building not in the trust fund at the time of death.Sidebar: Revocable Trust Vs An Irreversible Count On

- As an example, the count on record might include terms for dealing with assets of young kids or those with unique needs.

- The even more time and effort you put into planning for your future, the much more defense you'll have.

- As the name recommends, a pour-over will certainly takes all the assets you own in your single name at the time of your fatality and "pours" them into the trust you have created.

- This may force the living trust to go on for months after the fatality of the will and count on. maker.

Just How To Develop A Living Trust Fund With Put Over Will - Making Use Of A Pour-over Will In Estate Planning?

Sadly, any possessions that do not get transferred right into your depend on will be treated as your very own personal property. In other words, they will certainly have to go through the probate process and will be subject to estate tax. With the boost in households with youngsters from outside the existing marriage, a Florida will certainly or Florida pour-over will is vital to ensure your assets are distributed to your needs. The default provisions of the Florida statutes usually create undesired outcomes and can produce a challenge for your family members. Upon your death, assets kept in the living trust can transfer utilizing the depend on administration procedure. Assets held outside of the trust, on the other hand, would need to be resolved in a few other way. Because possessions in a Pour Over Will are not yet possessed by the Depend on, they need to experience probate prior to they can be moved over, and it's just then that they can recognize any type of benefits a Depend on needs to supply. LegalZoom gives access to independent lawyers and self-service tools. LegalZoom is not a law firm and does not offer lawful recommendations, other than where authorized via its subsidiary law firm LZ Legal Services, LLC. Use of our product or services is governed by our Regards to Usage and Privacy Plan. Without a will, when you die, your accounts and building will be distributed according to state law-- which could wind up being extremely different from just how you want them to be dispersed. If you die with a living count on and no pour-over will, what takes place relies on what estate preparation actions you took throughout your lifetime. If you put each and every single possession right into your trust fund, the count on deals with circulation of your assets and your estate does not go to probate court. If you left a possession out of the count on, it must be managed by the court of probate under your state's regulations of intestate sequence. When you pass away without a will, state laws determine who inherits your home, regardless of what your desires are. You might want to produce a pour-over will certainly to ensure that any type of possessions which remain in your name at your fatality are consisted of in your living trust fund. A pour-over will exists just to relocate assets right into the depend on and operates in conjunction with either a revocable living trust or an irreversible depend on. A pour-over will frequently serves as a "catch-all" for any kind Trusts of asset that was stagnated right into a depend on prior to the decedent died. If you don't resolve what occurs to properties held beyond your living trust fund after you pass away, the court will certainly need to determine what occurs to them. States have intestacy regulations which specify which member of the family must acquire. A pour-over will is an extremely basic file instructing that any type of assets you directly possess at the time of your fatality must be transferred to a living count on you have actually previously developed. A revocable count on is a sort of trust fund that can be revoked, changed, or upgraded if needed. It's a beneficial option if you wish to establish a living trust fund, and visualize the requirement to make modifications or choose having flexibility. This is in contrast to an irrevocable trust fund, which does not allow any changes to be made. Our guide discussing the difference between revocable and irreversible depends on highlight their respective advantages and drawbacks. Both revocable and unalterable counts on can be expensive to draw up, complicated to reverse, in the case of an irreversible trust fund, and costly to revise, when it comes to a revocable depend on. It is really difficult to liquify an irreversible count on, and a revocable depend on doesn't necessarily protect your possessions from financial institutions.Fellow Tally hands-on: A slick scale for precise pour-overs - Engadget

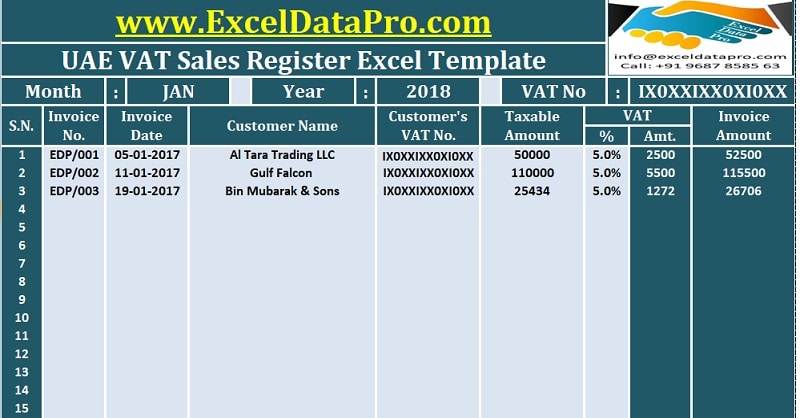

Fellow Tally hands-on: A slick scale for precise pour-overs.

Posted: Fri, 19 May 2023 07:00:00 GMT [source]

What occurs to an estate without a will in New York?

Social Links