August 27, 2024

Why Use A Discretionary Trust Fund?

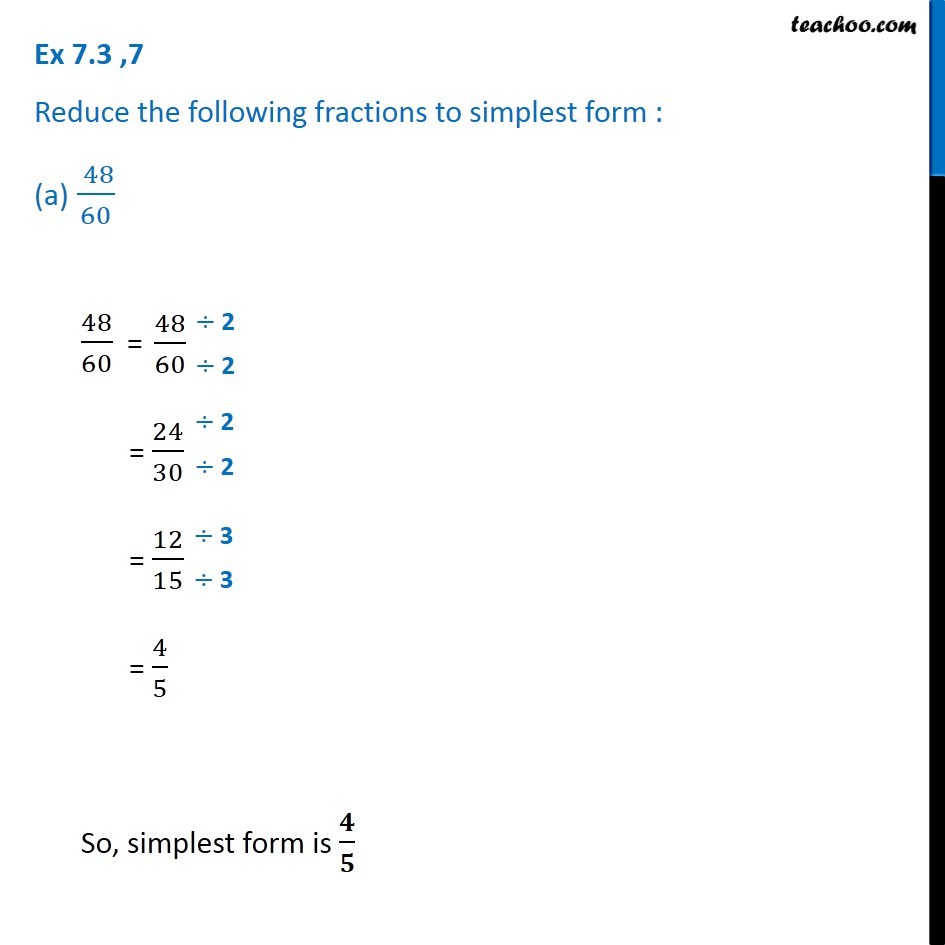

Usual Concerns In Our Inbox: Discretionary Depends On Following on from our take a look at building protection trust funds, this instalment will have to do with one of the other common will certainly counts on-- discretionary trusts. The rate of tax obligation levied on resources gains relies on the possession held within depend on, with house tired at 28% and other possessions https://nyc3.digitaloceanspaces.com/will-writing-service/legal-will-service/will-writing-experts/what-are-the-requirements-for-a-will-to-be-legitimate-in-br.html such as supplies and shares, tired at 20%. Due to the fact that unit trustees do not hold lawful civil liberties over the trust, it is trusted by the functions of the trustee. Since the trustee in unit counts on makes all the choices in behalf of the beneficiaries, the trustee may choose that the recipients don't concur with. In various other scenarios, the trustee will certainly make decisions that result in a loss and this will certainly imply the trust fund can not be dispersed between the beneficiaries. Work out which residential property and properties you desire the Depend deal with and what the worth of those possessions are.Creating a high-performance workplace by tapping into discretionary effort - HR Magazine

Creating a high-performance workplace by tapping into discretionary effort.

Posted: Thu, 25 Feb 2021 08:00:00 GMT [source]

Yearly Cost

Nonetheless, in cases where a settlor is likewise a beneficiary, the recipient might be taxed on any type of revenue emerging to the trustees. A discretionary trust can be created when the settlor is alive, or in their will. Discretionary depends on can seem odd presumably but there are numerous reasons that they may be an important part of your estate preparation. The ATO describes Trusts as "a specifying attribute of the Australian economic situation" and has approximated that by 2022 there will certainly be over 1 million Rely on Australia.Inquiring From Trustees

A well-drafted optional trust allows the trustee to add or omit recipients from the course, providing the trustee greater flexibility to resolve modifications in conditions. The depend on is discretionary because the trustee has the discernment to provide or refute some advantages under the count on. The recipients can not oblige the trustee to utilize any of the depend on building for their benefit. He or she will take care of the depend on and make certain that the properties are dispersed according to your desires. The trustee should be a person whom you trust to make smart choices about who must obtain money from the count on and how much they need to receive. As a discretionary affordable present depend on, there are no called recipients, simply a checklist of pre-determined individuals and other lawful entities that might beome a recipient. Note that the price estimation is based upon life time rates (half fatality rate), even if the count on was set up under the will of the settlor. The price of tax payable is then 30% of those rates applicable to a 'Theoretical Chargeable Transfer'. When analyzing the fee relevant when funds are dispersed to a recipient, we need to think about 2 circumstances. An optional trust fund can be a beneficial way to distribute organized riches to beneficiaries, yet they are not without downsides. One of the primary drawbacks of an optional depend on is the lack of openness between the trustee and the beneficiary. Simply put, optional counts on are a good estate planning device for those beneficiaries that may need extra help managing large sums of money. Considering that the recipients of a discretionary trust have no rights to its funds till they are dispersed, these funds may not be thought about component of the recipients' estates relying on the specifics of the trust. There are some even more vital reasons these counts on can be tax reliable. In addition to the decrease of the settlor's estate for IHT objectives, a more IHT advantage can arise by making certain some possessions pass outside of a spouse's ownership, which in time will reduce IHT on the 2nd death. Nevertheless, the RNRB might be recuperated if the building is assigned bent on route offspring within 2 years of the testator's day of death-- area 144 of the Inheritance Act 1984. Feel free to review your options initially with our team of lawyers and will certainly writers in Leicester. Merely complete the type, and we will quickly reach out and aid with everything you need to begin. For more info or guidance regarding Discretionary Trusts or Estate Planning as a whole, please contact us. We intend to supply fresh ideas, clear and simple explanations, and a service tailored specifically to you. With you at the centre, we make every effort to make the will certainly creating procedure as transparent as feasible. It is not feasible for a positive count on or a resulting depend occur as an optional depend on. Our specialist attorneys have considerable experience in producing and providing trust funds for our clients. Most importantly, one of the most crucial thing is to see to it your Will certainly fits in with your family conditions which it supplies assurance. Beneficiaries of a Discretionary Trust fund do not have any kind of legal claims over the Count on funds.- From tax obligation planning to household company and property protection, these types of household trusts are an efficient method to distribute revenue and properties held in your estate.

- When establishing a new count on you have to take into account any previous CLTs (e.g. gifts right into optional depends on) made within the last 7 years.

- If the value of the assets transferred to the count on has actually climbed because the settlor obtained it, the settlor may be responsible for Funding Gains Tax (CGT).

- The trustee is bound to make a circulation to the recipients in this fixed way as laid out in the trust fund deed.

- This is a huge benefit of a Discretionary Trust, as trustees can ensure the beneficiaries are cared for, however you can rest assured that the possessions will not be wasted.

- System trust funds can have considerable tax obligation advantages for unit holders as unit trust funds are ruled out different tax entities.

When to make use of discretionary trust?

A discretionary count on separates ownership from control. Possession by the trustee for the recipients of the household trust fund keeps possessions out of damage''s means from any kind of cases versus an individual. This is also where the individual may, as director of the trustee company, manage the trustee!

Social Links